Attn. Buy-to-Let Investors, Property Developers & Busy Professionals Looking to Replace Your Income

Maximise Your Portfolio Growth & Replace Your Salary in 12 Months

FREE Online Masterclass on Thursday 5th March (7pm - 8:30pm UK)

Join Us at

Property Masterclass for FREE

Just Two Hours of Learning To Get Light-Years Ahead Of The Property Game.

After you attend the Masterclass, I will also send you a digital copy of my best-selling book Property Entrepreneur as a gift to you.

Thursday 5th March 2026 (7pm - 8:30pm)

LIMITED PLACES PER CLASS!

Over the past 20 years, I have developed and perfected a system based on The Principle of Leverage that allows property investors to achieve extraordinary returns.

The end result is that you can build assets and a passive income for financial freedom 10x faster than traditional buy-to-let investing.

Let me show you step-by-step how this works in my upcoming Property Entrepreneur Bootcamp.

Vincent Wong

What Will You Be Learning?

You will learn the next-level strategies that will take you way beyond the traditional methods such as Buy-to-Let and Buy-Refurbish-Refinance (BRR) which are restrictive when it comes to your cash-flow income.

Consider this: A £300k buy-to-let property requires a 25% deposit—£75,000 upfront. After covering your mortgage and expenses, you’re left with just £300 net profit per month. Spending more time and money on BRR deals could actually leave you worse off. The reality is, most property investors sticking to the old ways are often cash-broke!

They are in a Catch 22 Situation!

In just 2 hours, live over Zoom, I’ll show you how to use my unique and powerful Cash 22 Strategy to massively boost your property income!

You’ll get a complete breakdown of the proven frameworks that my clients and I use to super-charge our portfolios.

I guarantee that this is something you've never seen before and will blow your mind!

THE CATCH 22

Struggle with Rental Income

Struggle to Find Deals on Rightmove

Do Expensive Renovations

Get Exposed to Interest Rates & Market Conditions

No Additional Revenue Streams

THE CASH 22

Don't Rely on the Rental

Have a Constant Dealflow

Leverage Their Time & Efforts

Unaffected by Interest Rates & Market Downturns

Have Multiple Streams of Income

In just 2 hours , I will share with you my advanced strategies that fundamentally change the way you look at property-investing. Using Cash 22, you can 5-10x your property income without the pressure of buying more properties and the headaches of managing too many tenants that could become a liability.

Who Is Property MASTERCLASS For?

This training is perfect for existing buy-to-let investors and property developers who want to boost their income and stop relying solely on rentals.

Busy professionals are welcome - we'll show you how to build a portfolio that can replace your salary in 12 months.

This training is NOT a Get-Rich-Quick scheme.

Please DO NOT register if you’re looking to make a quick buck to fix your financial circumstances. This is a strategy designed to take serious investors to their next levels.

Join Us at

Property Masterclass for FREE

Just Two Hours of Learning To Get Light-Years Ahead Of The Property Game.

After you attend the Masterclass, I will also send you a digital copy of my best-selling book Property Entrepreneur as a gift to you.

Thursday 5th March 2026 (7pm - 8:30pm)

LIMITED PLACES PER CLASS!

Get 2 Hours of Live Training With Me

Part One: How to Achieve Your Income Goals With Clarity

Your Magic Number: Figure out the minimum monthly income you need for financial freedom. We’ll work backwards from that goal.

Evaluate the Existing Strategies: Look at common strategies and see if they actually deliver the income you want.

Make it Fit For You: Explore the right strategy that matches your time, money, and lifestyle—so you can take real action and get results.

Part Two: The Cash 22 Strategy to Boost Your Income

Build a Cash-Rich Portfolio: Discover how wealthy investors grow their income 10x—without relying on slow buy-to-let returns.

The Cash 22 Strategy: Learn this unique, powerful, and life-changing method with 3 key steps to rapidly boost your portfolio income and build lasting wealth.

Part Three: Q&A with Vincent Wong

Among Some of My Clients Include

Well-Known Property Mentors Such As:

Daniel Kennedy

John Lee

Paul McFadden

Paul Preston

Milan Doshi

Valter Pontes

WATCH THEIR STORIES

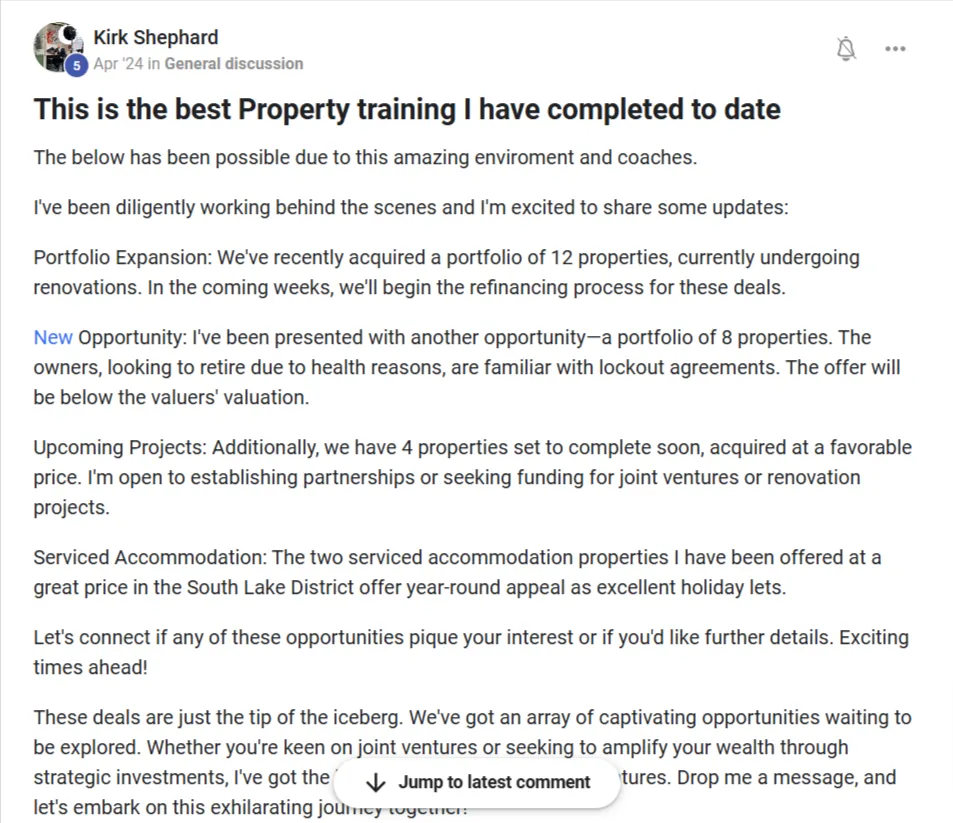

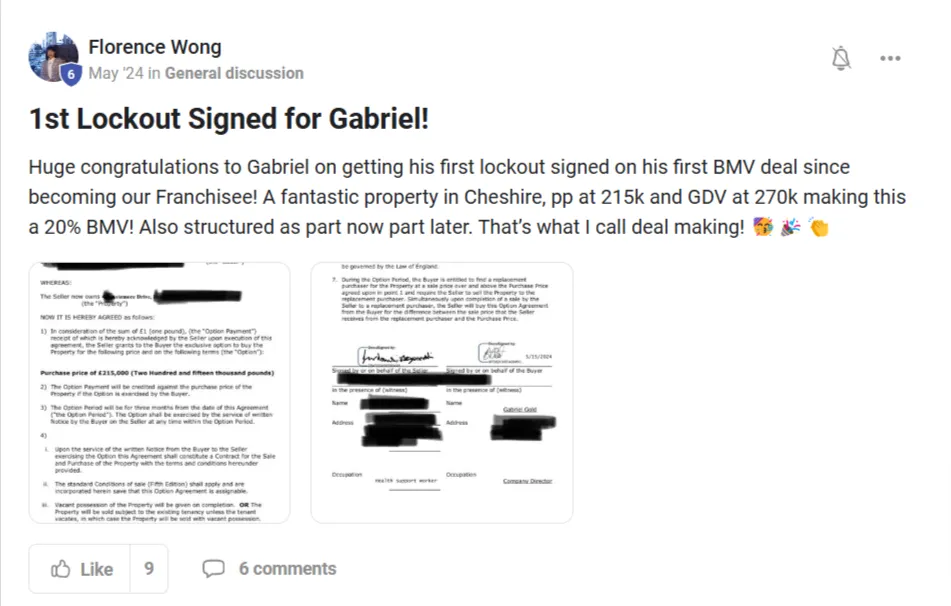

TRANSFORMING LIVES, ONE PROPERTY AT A TIME

Maha Made 340k in Battersea Deal

Sean Made 210k Cash in One flip

Daniel Made £169,919 Cash in First Flip

Sean Made 210,000 in First Flip

Paul Bought 6 properties in 6 months

Matthew Controlled £2.1m Hotels for £10k

Steve Bought £150k for £100k

Colin Flipped 70 Property Deals

Yawor Created £3.1m Portfolio

Valter Acquired 6 properties in London

Auramas Raised £210k for First Deal

Katie did First Lease Option Deal in 3 weeks

Join Us at

Property Masterclass for FREE

Just Two Hours of Learning To Get Light-Years Ahead Of The Property Game.

After you attend the Masterclass, I will also send you a digital copy of my best-selling book Property Entrepreneur as a gift to you.

Thursday 5th March 2026 (7pm - 8:30pm)

LIMITED PLACES PER CLASS!

Vincent Wong

Vincent began building his property portfolio in 1998 while working as a community pharmacist in the UK. By 2005, he had developed an innovative approach to finding property sellers online, and has since sourced, negotiated and closed over 1,000 property deals for himself and his investors.

In 2008, amid the financial crisis, Vincent pioneered the use of Lease Option to control assets without using mortgage financing or deposits. The following year, he co-founded Wealth Dragons to teach his revolutionary strategies. His training programs have educated over 10,000 people worldwide.

Vincent has authored several books, including Property Entrepreneur (Wiley), and is a regular expert on Property Question Time on Sky TV.